Vigo Money Transfer review: fees, tracking, locations & alternatives

Sending money across borders is a daily need for millions of people1 around the world, including the US. Whether you help your family back home, cover urgent expenses, or make international payments, choosing the right money transfer service matters. One name that still appears frequently – especially for cash pickup transfers – is Vigo Money Transfer.

Vigo is a long-standing remittance brand that was acquired by Western Union, meaning most Vigo transfers today run on Western Union’s global network. This gives the service strong reach and reliability, particularly in cash-based regions.

But is Vigo still a smart choice today? The answer is often mixed. Vigo remains a trusted and proven option, mainly for in-person cash pickups. At the same time, its fees and exchange rates can be higher than newer digital services.

What is Vigo money transfer?

Wondering what is Vigo money transfer exactly? It’s an international money transfer service that allows people to send money across borders for cash pickup, bank deposit, or other payout options – mostly through agent locations.

A brief history of Vigo

Vigo Money Transfer was founded in 1986 in the United States2. The company focused on helping immigrants send money back home, particularly to Latin America. At the time, reliable cross-border transfers were limited, and Vigo built its reputation by working closely with local agents, banks, and retail partners.

Merger with Western Union

In 20053, Western Union acquired Vigo Money Transfer. This acquisition allowed Western Union to strengthen its presence in key remittance corridors, especially in Latin America and Africa, where Vigo already had strong brand recognition.

Rather than immediately removing the Vigo name, Western Union continued to operate it as a sub-brand in certain regions. This helped retain customer trust while integrating Vigo’s infrastructure into Western Union’s global system.

What is Vigo now?

Today, Vigo is essentially Western Union in most cases.

- Transfers are processed through Western Union’s network

- Fees and exchange rates are aligned with Western Union pricing

- Tracking numbers and systems are shared

- Customer support is often handled by Western Union

In many countries, the Vigo brand still exists at agent locations, but functionally, users are using Western Union’s backend.

How does Vigo money transfer work?

Vigo is designed to be simple, especially for users who prefer cash-based or in-person transfers. The service (via Western Union) operates in over 190 countries and territories4.

It’s especially popular in:

- Mexico and central America

- Africa (Ghana, Nigeria, Senegal)

- South America

- Parts of Asia

Service availability depends on the sending and receiving country, as well as local regulations.

Can I use it affline (Agents)?

Yes. This is Vigo’s biggest strength. You can:

- Visit a Vigo or Western Union agent location

- Fill out a send form

- Pay in cash or debit (depending on location)

- Receive a tracking number (MTCN)

Recipients can collect money in cash from an authorized location by presenting:

- Valid ID

- Tracking number

- Sender details

While Vigo has an extensive network of physical locations, online sending under the Vigo brand is limited. In most cases:

- Online transfers are redirected to Western Union’s website or app

- Vigo functions more as an offline brand

If you want full online control, Western Union or digital alternatives are usually more convenient.

How does tracking work?

Every Vigo transfer comes with a Money Transfer Control Number (MTCN)5. This number allows:

- Senders to track transfer status

- Recipients to confirm availability

- Agents to verify transactions

- Faster resolution if issues arise

Tracking is instant once the transfer is processed.

Vigo money transfer fees & exchange rates

One of the most important things to understand before sending money is the Vigo money transfer rate and the total fees involved. While Vigo is known for reliability and wide availability, its pricing structure can sometimes make transfers more expensive than expected.

How are fees calculated?

Vigo money transfer fees are not flat for everyone. Instead, they depend on several key factors, such as:

Fees vary based on where you are sending money from

Some destinations cost more due to local partners and regulations

Larger amounts usually come with higher fees

Cash payments may cost less than card payments in some locations

Cash pickup is often more expensive than bank deposits

In most cases, fees are fixed and shown upfront, which is helpful for transparency. However, if you choose faster delivery options, such as same-day cash pickup, the fee can increase quickly.

In addition to transfer fees, Vigo also earns money through exchange rate margins. This means the exchange rate offered to customers is usually slightly worse than the real mid-market rate you see on Google or financial websites.

Example cost breakdown

Sending $300 from the United States to Mexico for cash pickup.

Roughly $5–$8

Same day or next business day

Around 1–2% above the market rate

While the money arrives quickly and reliably, the overall cost is higher compared to many digital-first services.

To avoid surprises, make sure to:

- Always compare the final amount the recipient receives, not just the fee

- Check how far the exchange rate is from the mid-market rate

- Review alternative services before confirming your transfer

This approach helps you choose the best value – not just the most familiar option.

Vigo money transfer locations

Vigo money transfer is widely used because of its strong physical presence, especially in countries where cash pickups are still the most common way to receive money.

Ghana

Vigo has strong coverage across major cities and smaller towns in Ghana. This makes it a reliable option for families who depend on regular remittances. Most payouts are handled through local partner banks and licensed forex bureaus, allowing recipients to collect cash quickly with a valid ID. In many cases, funds are available the same day.

Mexico

In Mexico, Vigo has thousands of cash pickup locations, largely because it operates through Western Union’s extensive agent network. Many Vigo locations are fully integrated with Western Union agents, including retail stores and financial service counters, making access convenient even in rural areas.

South America

Vigo is also popular across South America, especially in countries like Colombia, Peru, and Ecuador. The service relies heavily on retail partners and local banks, which helps ensure broad coverage in both urban and semi-rural regions.

Types of Locations

Vigo operates through different types of payout locations, including:

- Agents: Independent money service businesses and authorized remittance partners

- Stores: Supermarkets, convenience stores, and local retail outlets

- Banks: Partner banks in select countries, often suitable for larger payouts

This broad network makes Vigo especially convenient for recipients who do not have bank accounts or prefer cash-based transactions.

Vigo money transfer app

The Vigo money transfer app provides basic functionality for sending and managing international transfers; however, it feels more limited when compared to modern, digital-first money transfer apps.

This is largely because Vigo now operates under Western Union, and most app-based services are accessed through Western Union’s mobile platform rather than a fully independent Vigo app.

Platform Availability

The service is available on both major mobile platforms:

In most regions, users access Vigo services through the Western Union app, which may be confusing for those specifically searching for a Vigo-branded application.

Key features

Despite its limitations, the app covers the essentials needed to complete and manage transfers:

Send money to over 190 countries and territories for cash pickup or direct bank deposit.

View transfer fees and estimated exchange rates before confirming

Track transfers and get alerts when money is picked up.

Find nearby Vigo or Western Union agent locations for cash pickup

These features work reliably for users who already rely on in-person cash pickups.

UI/UX review

From a design perspective, the app is functional but dated. Navigation is simple; however, the interface lacks the smooth experience and clean layout offered by newer fintech apps. Some steps require extra taps, and the overall flow can feel less intuitive for first-time users.

Vigo’s heavy reliance on Western Union branding also means the app does not feel like a dedicated Vigo experience.

App store ratings

On app stores, the app typically holds average ratings between 3.1 and 3.5 stars6,7. Positive reviews mention reliability and wide availability, while common complaints focus on higher fees, slower app performance, and occasional technical issues.

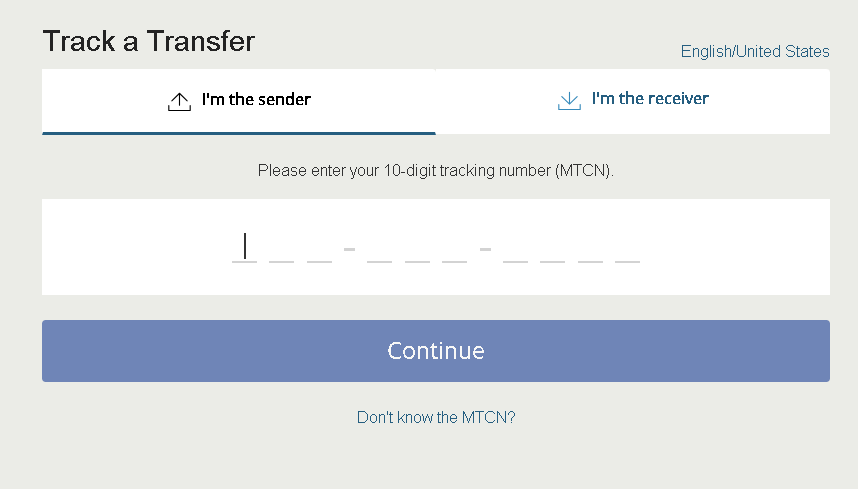

Vigo money transfer tracking

Vigo money transfer tracking is both simple and reliable. To track a Vigo (or Western Union) transfer, use the 10-digit MTCN (Money Transfer Control Number) on their website or app.

Here’s how to do it:

Find the 10-digit MTCN from your receipt or confirmation email.

Visit the "Track a Transfer" page on the Western Union website or use the mobile app.

Select if you're the sender or receiver, enter the MTCN, and click "Continue".

See if the transfer is ready, delivered, or if there are any holds (like for ID verification).

Is Vigo Money Transfer safe and legit?

Before sending money, many people often ask: is Vigo money transfer legit? This is a fair concern – especially when dealing with international transfers and cash pickups.

The short and clear answer is yes, Vigo money transfer is safe and legitimate. Since Vigo is part of Western Union’s global network, it complies with:

- International compliance standards that govern cross-border money transfers

- Anti-money laundering (AML) regulations to prevent fraud and illegal activity

- Know Your Customer (KYC) requirements, which help verify identities

- Secure transaction processing, both online and at physical agent locations

These measures ensure that funds are handled responsibly and that transactions are monitored for suspicious activity. For users, this means peace of mind – especially when sending money to family members who rely on cash pickups.

That said, safety doesn’t always mean best value. Though Vigo is reliable, it comes with trade-offs that are important to understand.

-

Trusted global brand backed by Western Union

-

Extensive agent network worldwide

-

Reliable cash pickup in many countries

-

Strong presence in developing markets

-

Higher fees compared to modern digital services

-

Exchange rate margins can be expensive

-

Limited digital-first experience

-

Less transparent pricing structure

Alternative to Vigo Money Transfer

Although Vigo Money Transfer is a reliable and well-established service, it’s not always the best choice when it comes to cost and digital convenience. Many users today prefer faster, app-based solutions with lower fees. One strong alternative that fits this need is BOSS Money.

Both services allow international money transfers, but they are designed for different types of users. Understanding these differences can help you choose the option that works best for you.

Vigo money transfer often comes with higher fees and wider exchange rate margins, particularly on cash pickup services. These costs can add up, particularly for frequent transfers.

BOSS Money, on the other hand, offers more competitive pricing, with lower fees and better exchange rates, making it a more budget-friendly option.

Vigo transfers typically arrive the same day or within 1-5 business days8, depending on the destination and payout method. BOSS Money is usually faster, with many transfers completed instantly or on the same day, especially when sending to bank accounts or mobile wallets.

Vigo performs well for users who prefer in-person transactions through agents and stores. However, its online experience is more limited. BOSS Money is built for online and mobile users, allowing transfers to be completed entirely through a smartphone app.

Vigo is ideal for cash pickup and physical locations, making it useful in areas with limited banking access. BOSS Money offers a strong digital-first experience, including easy setup, quick transfers, and clear tracking.

Final verdict: is Vigo worth it

There you have it! Now you know that Vigo Money Transfer remains a reliable choice for sending money internationally, especially for users who value in-person service and cash pickup locations.

Backed by Western Union’s global network, Vigo offers strong coverage, trusted security, and dependable delivery in many popular remittance corridors. For recipients without bank accounts, its wide agent presence is a clear advantage.

However, this reliability often comes at a higher cost. Fees and exchange rate margins can make Vigo more expensive than newer digital services, particularly for frequent transfers. In addition, its limited online experience feels outdated compared to mobile-first platforms.

If you need a trusted, offline-friendly money transfer service, Vigo money transfer is a solid option. But if cost, speed, and app convenience matter most, modern alternatives like BOSS Money may offer better value.

Sources: all third party information obtained from applicable website as of December 30, 2025

-

https://blogs.worldbank.org/en/psd/remittances-and-the-high-cost-of-generosity

-

https://www.bloomberg.com/profile/company/191167Z:US

-

https://www.sec.gov/Archives/edgar/data/1365135/000119312506188810/dex991.htm

-

https://www.westernunion.com/blog/en/western-union-digital-services-live-in-40-countries/

-

https://www.westernunion.com/us/en/what-is-mtcn.html

-

https://apps.apple.com/us/app/vigo-money/id6480349377

-

https://play.google.com/store/apps/details?id=com.westernunion.oneapp.us&hl=en

-

https://www.westernunion.com/us/en/bank-account-transfer-details.html#:~:text=Frequently%20asked%20questions,bank%20details%20when%20sending%20money?

This article is provided for general information purposes only and is not intended to address every aspect of the matters discussed herein. The information in this article is not intended as specific personal advice. The information in this article does not constitute legal, tax, regulatory or other professional advice from IDT Payment Services, Inc. and its affiliates (collectively, “IDT”), and should not be taken or used as such by any individual. IDT makes no representation, warranty or guaranty, whether express or implied, that the content in this article is current, accurate, or complete. You should obtain professional or other substantive advice before taking, or refraining from, any action on the basis of the information in this article.