M-PESA international money transfer guide

M-PESA is a fintech platform with a mobile app that is fast gaining popularity across Africa. Since it does not require users to have a bank account, even individuals without access to traditional banking services can use it. This is why it has become one of the most preferred ways to send money and make payments in the region.

However, M-PESA is available in only eight countries in Africa1. If you are in another country, such as the United States, you will have to use other international money transfer service providers like BOSS Money to send money to an M-PESA account.

In this guide, we explore what M-PESA is, how it works, and how to send money to M-PESA from the USA. We also talk about the M-PESA fees and limits you might expect when using its services.

What is M-PESA and how does it work?2,3,4,5

M-PESA was initially launched by Vodafone in Kenya in 2007. Back then, it merely served as a way to send money within the country through text messaging. Over the years, it has become a mobile payment platform with money transfer and financial service offerings.

When M-PESA was fully acquired by Safaricom and Vodacom in 2020, its growth accelerated, quickly becoming one of the largest mobile money services in Africa. By 2024, it was already serving more than 66.2 million customers.

Aside from Kenya, M-PESA is also available in seven other countries in Africa: the Democratic Republic of Congo, Egypt, Ethiopia, Ghana, Lesotho, Mozambique, and Tanzania.3

How does M-PESA work2,6,7

M-PESA works as a mobile wallet app that can be used to send and receive money, pay bills and purchases, top up mobile airtime credits, or access financial services like short-term loans.

To process an M-PESA money transfer, you just need to follow these steps:

1. Register

Go to an authorized M-PESA agent. Bring a valid government-issued ID and a mobile phone with a Safaricom SIM card. Register your mobile phone number. Activate your account using the 4-digit PIN sent to the number you registered.

2. Deposit cash

Give the agent the cash amount you want to exchange for electronic money. The e-money will be sent to your M-PESA account in real time. You can keep the money in your wallet, send it to another person, or use it to make payments.

3. Send money

Use a SIM toolkit, the M-PESA Super app, the Safaricom app, or a short code to send money to anyone in your region, even if they are not M-PESA users. Provide the amount you wish to send, their mobile phone number, and other required information to process the transfer.

4. Confirm

Enter your PIN or use biometrics to confirm the transaction. Wait for SMS confirmation that the transfer is successful.

Your recipient will also receive an SMS notification once the transfer is processed. They can then either withdraw cash at a nearby M-PESA agent or keep the funds in their M-PESA wallet, which they can use to pay for goods or services from M-PESA merchants.

Can you send money to M-PESA from the USA?

Yes — but only through a third-party provider of money transfer services.

You can’t send money directly to an M-PESA account if you are located in the United States. You need an international money transfer service provider that allows delivery to mobile wallets in Africa to facilitate the transfer. Some of the best options include BOSS Money, Western Union, and Wise.

With BOSS Money, you only need the recipient’s name and phone number to send funds to their M-PESA account. Once the transfer is confirmed, the recipient typically gets the money within a few minutes.

What’s great about BOSS Money is that you can send funds even to non-M-PESA users. BOSS Money has many other delivery options to Kenya, including bank deposit, direct to debit, and mobile wallet.

Step-by-step guide on how to send money to M-PESA from the USA

To send money from the US to an M-PESA account in Kenya, download the BOSS Money App and create a free account. All you need to provide is your name, mobile number, email address, and home address. Once your account is verified, follow the steps below:

- Open the BOSS Money app.

- Tap “Send Money” and select Kenya from the list of countries.

- Enter the amount you want to send.

- Choose mobile wallet as your delivery method, then select M-PESA.

- Add the recipient’s details, including their full name, address, and mobile number.

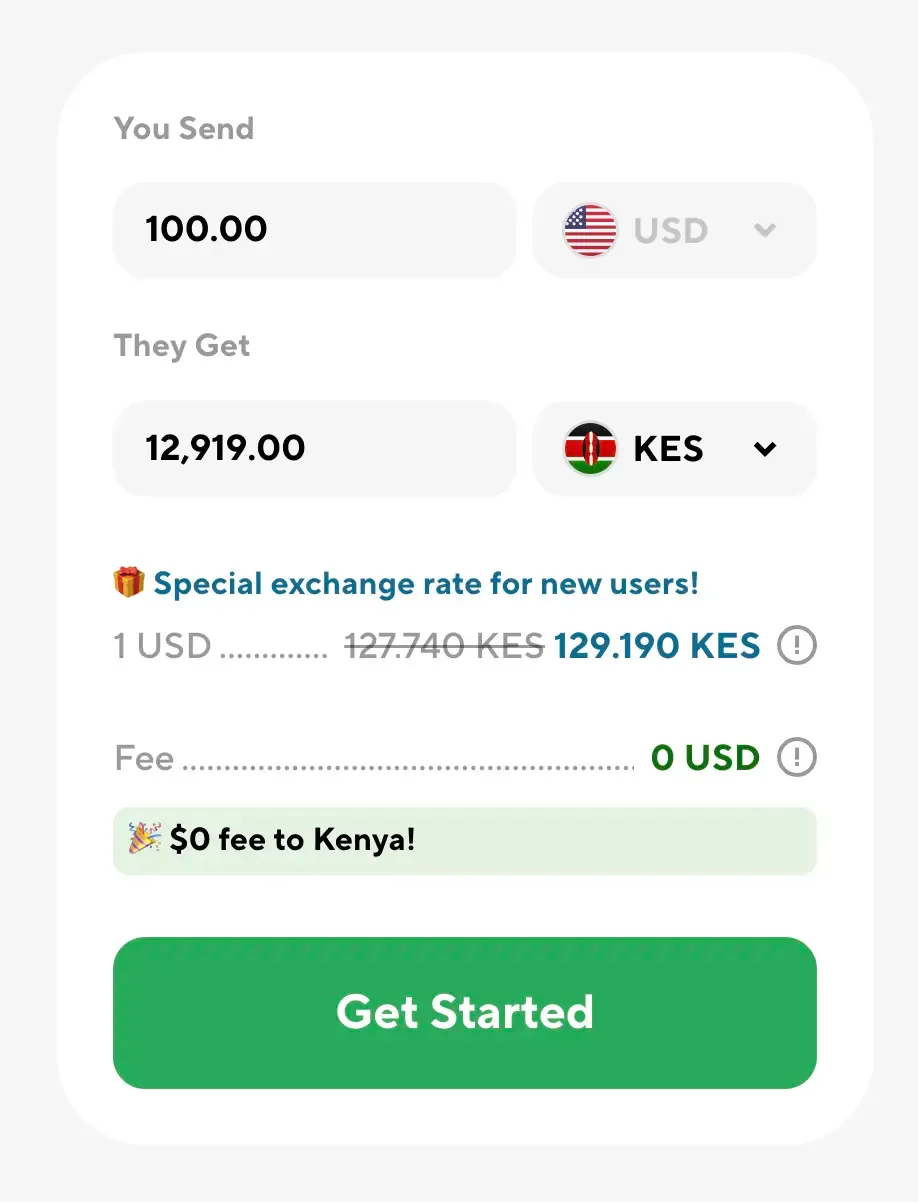

- Choose the payment method (debit or credit). For new users, their first two transfers to Kenya are free of charge.

- Review the transaction details, then tap “Send.”

When you send money to Kenya, M-PESA users get notified via SMS and receive the funds almost instantly. Recipients are not charged any fees and get the exact amount shown in the app before you confirm the transaction.

M-PESA international transfer fees and rates8

M-PESA users can send international transfers to bank accounts, mobile numbers, or Western Union locations worldwide through the M-PESA Global service. These transfers are subject to a tiered fee structure based on the amount sent.

When receiving international transfers, though, M-PESA does not typically charge users for the incoming transfers. The service provider, however, may impose fees on either the sender or the recipient. Currency conversion rates or markups may also be charged during the transaction.

With BOSS Money, these fees are shown clearly during the transfer process. You will know the exchange rate, transfer fees, and the exact amount your recipient will get before you confirm the transaction. This transparency makes BOSS Money a reliable partner for sending money abroad.

Source: https://www.bossmoney.com/en-us/send-money/kenya?currency=KES&amount=100

Limits and restrictions when sending money to M-PESA9

M-PESA imposes restrictions on transaction amounts and wallet balances. For example, you can send up to KES 250,000 per transaction to an M-PESA account. Below are the M-PESA limits you might expect when you use its services.

| Minimum amount9 | Maximum amount9 | |

|---|---|---|

| Account balance | n/a | KES 500,000 (~USD 3,872) |

| Transaction amount | KES 1 (~USD 0.0077) | KES 250,000 (~USD 1,936) |

| Daily transaction value | n/a | KES 500,000 (~USD 3,872) |

| Cash withdrawal (agent outlet) | KES 50 (~USD 0.39) | KES 250,000 (~USD 1,936) |

| ATM withdrawal | KES 200 (~USD 1.55) | KES 35,000 (~USD 271) |

International money transfers through M-PESA Global8 are capped at KES 70,000 (approximately USD 542). There is also a minimum amount of KES 101 (USD 0.78) required for sending money abroad from Kenya.

Advantages of using M-PESA for international money transfers

One of the factors that draws users to M-PESA is its accessibility for unbanked individuals. Since it only requires an ID and a Safaricom SIM, even those in rural or underserved areas can use the platform and send money abroad.

Aside from this, M-PESA also has several other advantages that make it great for money transfers.

Fast crediting

Transfers between M-PESA accounts are almost instantaneous. Most international money transfers are also processed and sent within the day. Incoming transfers sent via BOSS Money, specifically, are often credited to the recipient’s M-PESA wallet within minutes.

This short transfer time makes M-PESA a dependable way to send emergency funds or regular financial support to family members.

Convenience

M-PESA makes it easy for the recipient to withdraw cash or use the e-money to pay for purchases directly from the wallet. Payments through M-PESA are accepted by over 550,000 online and retail merchants.4

Low fees

M-PESA has no registration or deposit fees10. Although other transactions, such as ATM withdrawals, global transfers, and P2P payments incur charges, M-PESA rates are still comparatively lower than what traditional banks charge for international wire transfers.

Trusted ecosystem

Since it is operated by Safaricom and Vodacom, M-PESA is backed by a reliable infrastructure that consumers trust. Users are assured that their money will arrive safely and that they will get the quality of service they expect.

How do I send money to M-PESA from the USA?

To send money to an M-PESA account from the United States, use a reliable money transfer service like BOSS Money, Wise, or Western Union. These service providers all have mobile wallets as a delivery option and can process M-PESA transfers in Kenya and other countries where M-PESA is available.

How long does it take for M-PESA to receive funds from abroad?

In general, the transfer time depends on the international money transfer service provider used. When processed through traditional banking, transfers may take several days. Through BOSS Money, though, transfers arrive within minutes. The funds instantly reflect on the recipient’s M-PESA account.

What is the cheapest way to send money to Kenya via M-PESA?

If you are sending money to Kenya from the United States, using the BOSS Money App is one of the most affordable ways to transfer funds to an M-PESA account. The first two transfers are free of charge for new users. When using a debit card, the fees for succeeding transfers start from just $0.

Is there a limit for sending money to M-PESA?

Yes, there are limits for sending money to M-PESA. For one, the maximum wallet balance allowed in an M-PESA account is only KES 500,000. Amounts higher than that may not be accepted. M-PESA also sets a maximum amount of KES 250,000 per transaction, with a daily cap of KES 500,000.

Does M-PESA charge the recipient for international transfers?

No, there are no fees charged to the recipient for receiving international money transfers to their M-PESA wallet. However, if the recipient decides to withdraw cash via agent or ATM, standard local M-PESA withdrawal fees will apply based on the amount withdrawn.

Can I use BOSS Money to send money to M-PESA?

Yes. BOSS Money supports international transfers of up $5,000 per transaction to mobile wallets, bank accounts, debit cards, and cash pickup locations. This means you can use BOSS Money to send up to KES 250,000 per transaction to any M-PESA user in Africa.

Sources: all third party information obtained from applicable website as of July 18, 2025

-

https://www.m-pesa.africa/what-is-mpesa

-

https://www.vodafone.com/about-vodafone/what-we-do/m-pesa#How-it-started

-

https://www.m-pesa.africa/about-us

-

https://www.vodacom.com/pdf/what-we-do/2022/scale-financial-and-digital-services.pdf

-

https://www.statista.com/statistics/1139190/m-pesa-customer-numbers/

-

https://www.safaricom.co.ke/main-mpesa/m-pesa-for-you/getting-started/using-m-pesa

-

https://www.m-pesa.africa/how-it-works

-

https://www.safaricom.co.ke/media-center-landing/frequently-asked-questions/m-pesa-global

-

https://www.safaricom.co.ke/main-mpesa/m-pesa-for-you/tariffs-limits/consumer-tariffs-limits

-

https://www.safaricom.co.ke/main-mpesa/m-pesa-for-you/tariffs-limits/m-pesa-to-bank-and-bank-to-m-pesa-tariffs

This article is provided for general information purposes only and is not intended to address every aspect of the matters discussed herein. The information in this article is not intended as specific personal advice. The information in this article does not constitute legal, tax, regulatory or other professional advice from IDT Payment Services, Inc. and its affiliates (collectively, “IDT”), and should not be taken or used as such by any individual. IDT makes no representation, warranty or guaranty, whether express or implied, that the content in this article is current, accurate, or complete. You should obtain professional or other substantive advice before taking, or refraining from, any action on the basis of the information in this article.